Posted by Crime Tech Solutions – Your source for analytics in the fight against crime and fraud.

NOTE: This great article is property of International Association of Crime Analysts and is posted in it’s original format HERE…

What do Crime Analysts Do?

One: Finding Series, Patterns, Trends, and Hot Spots as They Happen

Crime analysts review all police reports every day with the goal of identifying patterns as they emerge. If a burglar starts targeting drugs stores in your jurisdiction, a crime analyst will let you know on the second incident. If domestic violence becomes a recurring problem in one family, an analyst will catch it. If your city, town, or county faces any emerging problem—youth disorder on a particular street, street robbery hot spots, new trends in fraud and forgery, a pattern of items being stolen from cars—your analyst can identify it and alert you about it as soon as possible.

Analyses of these trends, patterns, and hot spots provide you with the who, what, when, where, how, and why of emerging crime in your community. You can use this information to develop effective tactics and strategies, interceding as soon as possible, preventing victimization, and reducing crime.

Two: Researching and Analyzing Long-Term Problems

Crime analysis isn’t just about immediate patterns and series:analysts also look at the long-term problems that every police department faces. From a park that has been a drug-dealing hot spot for 20 years to a street that has a high number of car accidents to ongoing issues with crime and disorder at budget motels, a crime analyst can take it apart, explore its dimensions, and help the police department come up with long-term solutions.

Three: Providing Information on Demand

How often have you been frustrated getting the information you need from your records management or CAD system? Crime analysts know how to extract data from records systems, ask questions of it, and turn it into useful information. They know how to get data from other sources, and how to work with it. They know how to create charts, maps, graphs, tables, and other visual products.

Whether you need a list of all the incidents of youth violence over five years, or a chart showing trends in OUI arrests, or some statistics on motor vehicle citations, or a map showing an upcoming parade route, or an estimate of how many officers you’ll need in five years if current population trends continue, a trained crime analyst can put it together quickly and clearly.

Four: Developing and Linking Local Intelligence

Since September 11, 2001, we hear a lot about the need for intelligence. But what is it? And what does it have to do with local police departments?

Intelligence describes special information about criminals and criminal organizations: their goals, their activities, their chains of command, how money and goods flow through them, what they’re planning, and so on. Analyzing intelligence data on national and international problems is generally the responsibility of national and international agencies, but local police departments and local analysts play an important role.

First, as information synthesizers, crime analysts often know when local information or intelligence fits with state, national, or international intelligence. If the FBI issues a bulletin stating that terrorists are using forged passports from Belgium, your analyst will know to pay special attention when one of your reports mentions a Belgian passport. If a state agency issues a report on motorcycle gangs, your analyst can integrate that with your own police reports. In the post-September 11 world, you’re bombarded with information from multiple agencies at multiple levels; with a crime analyst, you have someone who can sift through this information and extract what’s relevant to your agency.

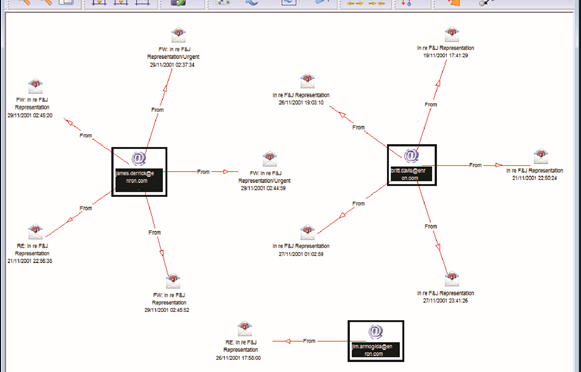

Second, your crime analyst can apply criminal intelligence analysis tactics to your local problems. Do you need a link chart showing the relationships between members of a local street gang? Or a carefully-crafted timeline for a court presentation? An analyst is trained in such techniques.

Five: Making Your Department Look Good

A crime analyst makes you and your agency look good to the public and to local government officials. You’re fully informed about a crime pattern before the press calls about it. The analyses, statistics, and charts on your web site and in printed publications convey that you are on top of crime and disorder. And when someone wants some information—whether a town selectman looking for statistics on juvenile liquor parties or a reporter looking for the top accident hot spots—you can provide it completely and quickly.

Crime analysts can also enhance the things you already do. Their desktop publishing skills can breathe new life into your reports, newsletters, and alerts; their graphing and charting skills can spice up your community presentations and budget requests; and their overall analysis and communications skills means that you always have someone on hand to explain crime and disorder—whether in meetings, interviews, or formal presentations—to the members of the community you serve.

by Sacha Breite, head of future payments at SIX Payment Services.

by Sacha Breite, head of future payments at SIX Payment Services.