Posted by Douglas Wood.

Posted by Douglas Wood.

Journalist Raj Shekhar had an interesting article in the Times of India this week.

It’s like PreCrime, only four decades early. The “predictive policing” system seen in the Tom Cruise blockbuster Minority Report is now taking shape in Delhi. But instead of the three slime-immersed psychic “Precogs” that system relied on, Delhi Police’s crime prediction will be based on cold, hard data.

Once Enterprise Information Integration Solution or ‘EI2S’—a system that puts petabytes of information from more than a dozen crime databases at police staff’s fingertips—is ready, Delhi Police will be able to implement its ‘Crime Forecast’ plan to predict when and where criminals will strike.

The technology is not as fanciful as it seems at first and is already being tried out in many important cities, including New York, Los Angeles, London and Berlin. Officers associated with the plan say the software will analyze police data for patterns, compare it with other data from jails, courts and other crime-fighting agencies, and alert police to the likely threats. Data will be available not only on the suspects but also their likely victims.

A global tender has been floated for the project and Delhi Police is in talks with various firms for the technology.

According to the article, the system can help pre-empt many situations. For example, a violent clash between two gangs. It can identify individuals who are likely to join gangs or take to crime in an area based on the analyses of their behaviour and network. It can also curb domestic violence by identifying a pattern and predicting the next attack, the article said.

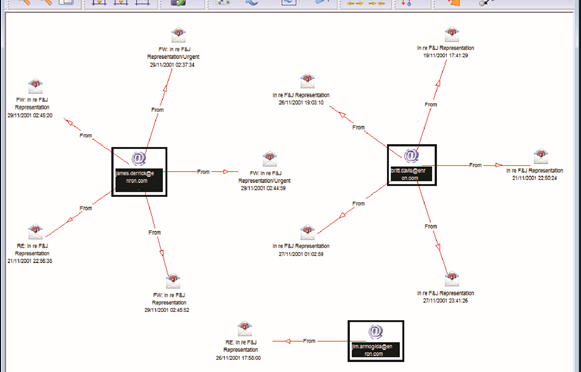

It all boils down to spotting patterns in mountains of data using tremendous computing power. A police document about the plan states that investigators should be able to perform crime series identification, crime trend identification, hot spot analysis and general analysis of criminal profiles. Link analysis will help spot common indicators of a crime by establishing associations and non obvious relationships between entities.

Using neighbourhood analysis, police will be able to understand crime events and the circumstances behind them in a small area as all the crime activity in a neighbourhood will be available for analysis. Criminal cases will be classified into multiple categories to understand what types of crime an area is prone to and the measures needed to curb them. Classification will be done through profiles of victims, suspects, localities and the modus operandi.

Another technique, called proximity analysis, will provide information about criminals, victims, witnesses and other people who are or were within a certain distance of the crime scene. By analyzing demographic and social trends, investigators will be able to understand the changes that have taken place in an area and their impact on criminality.

Network analysis will also be a part of this project to identify the important characteristics and functions of individuals within and outside a network, the network’s strengths and weaknesses and its financial and communication data.

While the system could help fight crime and rid Delhi of its ‘crime capital’ tag, it is bound to raise concerns over privacy and abuse as no predictive system can be foolproof.

Tag Archives: investigative case management

Swoop 'n Squat, Army strong, and major case management: This week's Crime Technology headlines:

Posted by Douglas Wood, Editor.

Swoop and Squat…

http://www.propertycasualty360.com/2015/03/09/swoop-squat-beware-of-these-insurance-fraudsters

Army strong analytics…

http://www.military.com/daily-news/2015/03/27/army-improves-systems-testing-to-deliver-more-capability-to-figh.html

Investigative Case Management…

http://www.mvariety.com/cnmi/cnmi-news/local/75212-commonwealth-bureau-of-investigation-has-a-new-building

WorksafeBC introduces new Major Case Management (MCM) protocols…

http://www.workerscompensation.com/compnewsnetwork/workers-comp-blogwire/20898-worksafe-bc-posts-update-on-safety-review-plan.html

The Name Game Fraud

Posted by Douglas Wood, Editor. Alright everybody, let’s play a game. The name game!

Posted by Douglas Wood, Editor. Alright everybody, let’s play a game. The name game!

“Shirley, Shirley bo Birley. Bonana fanna fo Firley. Fee fy mo Mirley. Shirley!” No, not THAT name game. (Admit it… you used to love singing the “Chuck” version, though.)

The name game I’m referring to is slightly more sinister, and relates to the criminal intent to deceive others for gain by slightly misrepresenting attributes in order to circumvent fraud detection techniques. Pretty much anywhere money, goods, or services are dispensed, folks play the name game.

Utilities, Insurance, Medicaid, retail, FEMA. You name it.

Several years ago, I helped a large online insurance provider determine the extent to which they were offering insurance policies to corporations and individuals with whom they specifically did not want to do business. Here’s what the insurer knew:

- They had standard application questions designed to both determine the insurance quote AND to ensure that they were not doing business with undesirables. These questions included things such as full name, address, telephone number, date of birth, etc… but also questions related to the insured property. “Do you live within a mile of a fire station?”, Does your home have smoke detectors?”, and “Is your house made of matchsticks?”

- On top of the questions, the insurer had a list of entities with whom the knew they did not want to do business for one reason or another. Perhaps Charlie Cheat had some previously questionable claims… he would have been on their list.

In order to circumvent the fraud prevention techniques, of course, the unscrupulous types figured out how to mislead the insurer just enough so that the policy was approved. Once approved, the car would immediately be stolen. The house would immediately burn down, etc.

The most common way by which the fraudsters misled the insurers was a combination of The Name Game and modifying answers until the screening system was fooled. Through a combination of investigative case management and link analysis software, I went back and looked at several months of historical data and found some amazing techniques used by the criminals. Specifically, I found one customer who made 19 separate online applications – each time changing just one attribute or answer slightly – until the policy was issued. Within a week of the policy issue, a claim was made. You can use your imagination to determine if it was a legitimate claim. 😀

This customer, Charlie Cheat (obviously not his real name), first used his real name, address, telephone number, and date of birth… and answered all of the screening questions honestly. Because he did not meet the criteria AND appeared on an internal watch list for having suspicious previous claims, his application was automatically denied. Then he had his wife, Cheri Cheat, complete the application in hopes that the system would see a different name and approve the policy. Thirdly, he modified his name to Charlie Cheat, Chuck E. Cheat, and so on. Still no go. His address went from 123 Fifth Street to 123-A 5th Street. You get the picture.

Then he began to modify answers to the screening questions. All of a sudden, he DID live within a mile of a fire station… and his house was NOT made of matchsticks… and was NOT located next door to a fireworks factory. After almost two dozen attempts, he was finally issued the policy under a slightly revised name, a tweak in his address, and some less-than-truthful answers on the screening page. By investing in powerful investigative case management software with link analysis and fuzzy matching this insurer was able to dramatically decrease the number of policies issued to known fraudsters or otherwise ineligible entities.

Every time a new policy is applied for, the system analyzes the data against previous responses and internal watch lists in real time. In other words, Charlie and Cheri just found it a lot more difficult to rip this insurer off. These same situations occur in other arenas, costing us millions annually in increased taxes and prices. So, what happened to the Cheats after singing the name game?

Let’s just say that after receiving a letter from the insurer, Charlie and Cheri started singing a different tune altogether.