Posted by Tyler Wood, Operations Manager at Crime Tech Solutions

The topic of fraud is widely discussed, and the focus of thousands upon thousands of articles. Television shows such as Crime, Inc and American Greed have become popular due, in part, to our fascination with the topic of fraud.

The topic of fraud is widely discussed, and the focus of thousands upon thousands of articles. Television shows such as Crime, Inc and American Greed have become popular due, in part, to our fascination with the topic of fraud.

The organizations that are affected by fraud are also fascinated… but for entirely different reasons. Some estimates suggest that the US economy loses 11 trillion dollars each year due to one form of fraud or another. It’s little wonder, therefore, that the companies most frequently defrauded have been heavily investing in anti-fraud technologies at an increasing rate over the past decade or more.

The biggest problem with fraud, of course, is that it is always evolving in a very Darwinian fashion. Like a living, breathing entity, fraud schemes change over time in order to survive. As the targets of fraud schemes put new policies, procedures and/or systems to deter the activities, the schemes modify and find new ways to survive.

So, since the nature of criminal activity is such that they constantly change, how do investigators find a fool proof methodology to ensure they are 100% safe from them? The answer, of course, is that they can’t. They never will; at least not until we live in a world such as the one depicted in the 2002 film Minority Report, starring Tom Cruise. In that movie, criminals are arrested prior to committing a crime based upon the predictions of psychics called ‘Precogs’. Corporations and individual targets of fraud can only wish.

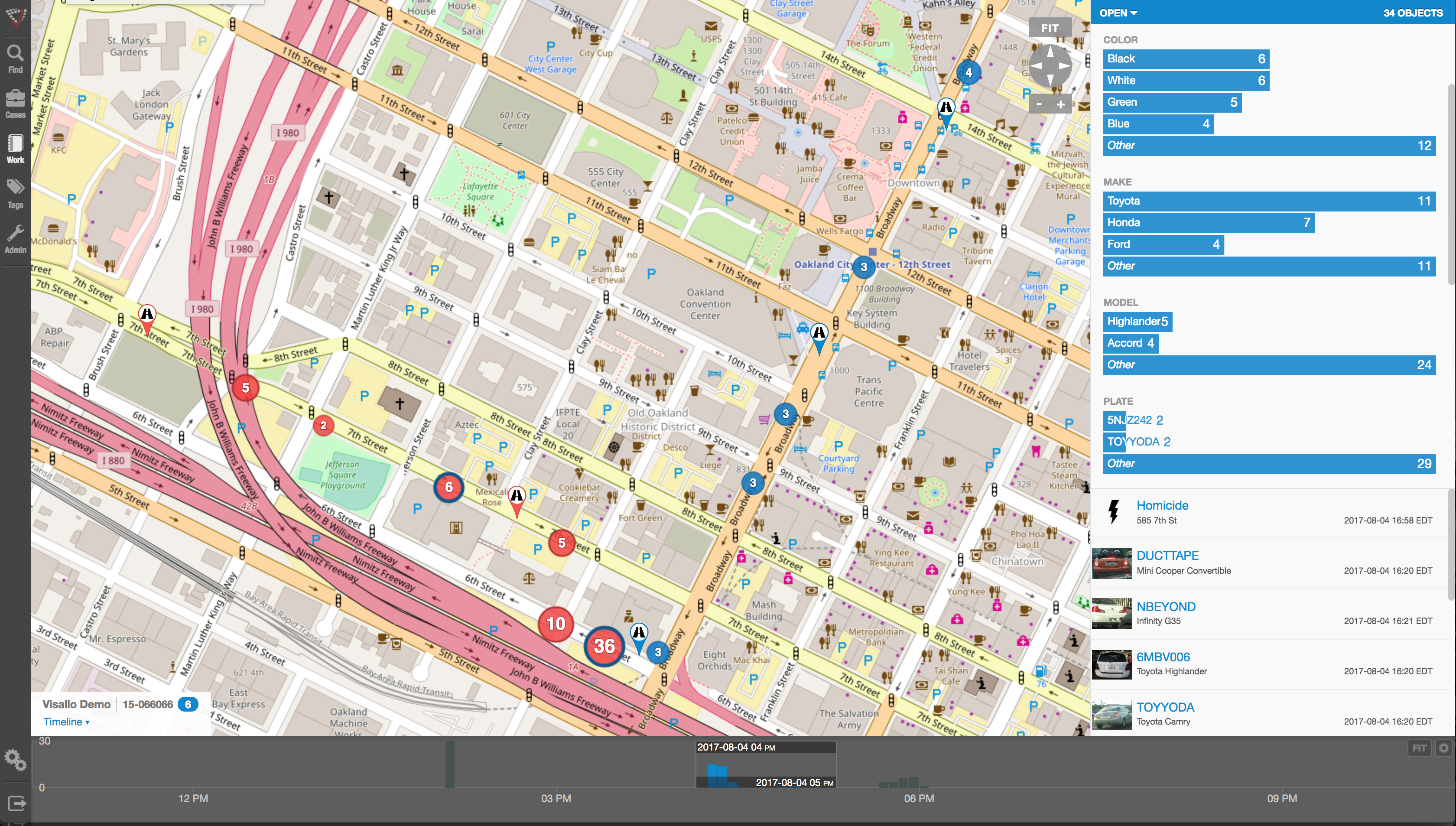

Nope, there are no Precogs running around locking up would-be practitioners of fraud that would protect banks, insurance companies, Medicaid and Medicare programs, victims of Ponzi schemes, victims of identity theft, and countless others. Instead, organizations rely upon skilled knowledge workers using purpose-built crime and fraud analytics technology that can detect anomalies in patterns, suspicious transactions, hotspot mapping, networks of fraudsters, and other sophisticated data analytics tools.

Crime and fraud analytics

Any discussion of analytics and investigation software must touch upon the topic of ‘big data’. No longer just a buzz word, big data literally fuels the insights gathered by organizations in every area of business. Naturally, then, organizations who have been traditionally targeted by fraudsters have increasingly invested in crime technology such as investigation software and analytics in order to exploit the phenomenon.

Of course, big data in and by itself does nothing. It just sits there. Nobody has ever yelled “Help! We’ve been defrauded! Call the big data!” Big data is only useful when it can be transformed into ‘smart data’. In other words, understanding the big picture of costly fraudulent activities is not akin to understanding the specifics of ‘who’ is defrauding you, and ‘how’ they are doing it.

Of course, big data in and by itself does nothing. It just sits there. Nobody has ever yelled “Help! We’ve been defrauded! Call the big data!” Big data is only useful when it can be transformed into ‘smart data’. In other words, understanding the big picture of costly fraudulent activities is not akin to understanding the specifics of ‘who’ is defrauding you, and ‘how’ they are doing it.

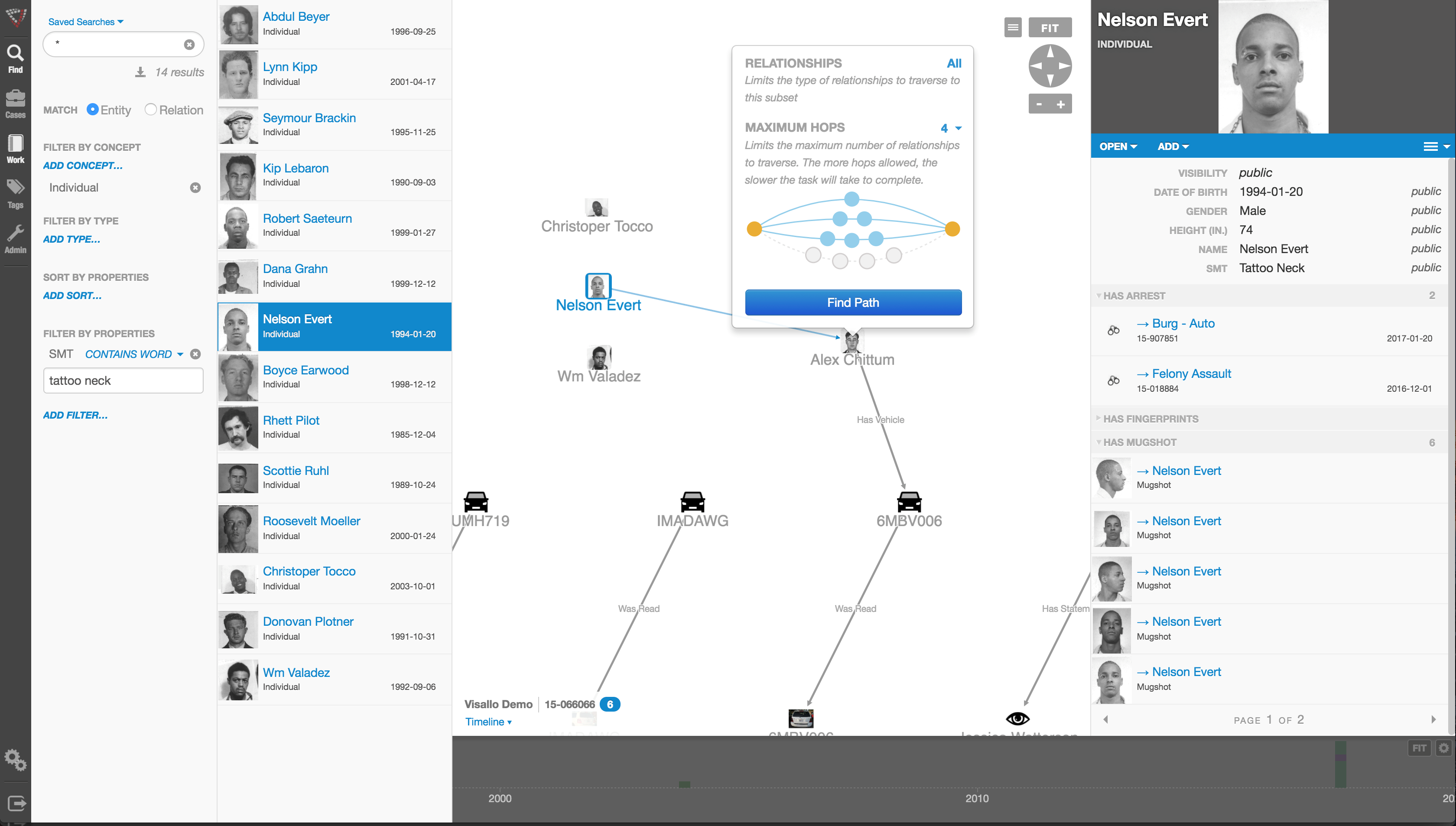

Those questions can best be answered through the powerful data mining and link analysis software tools offered by Austin, TX based Crime Tech Solutions in partnership with Sterling, VA based Visallo. Effective link analysis complements big data analytics platforms, helping to expose previously undetected fraud, and the entities (people or organizations) committing it.

Link Analysis – Transforming big data into smart data

By definition, link analysis is a data analysis technique that examines relationships among people, places, and things. As a visual tool, link analysis provides users a powerful method to quickly understand and ‘see’ what is happening. Because of this, it is widely used by financial institutions such as banks and insurance companies to uncover criminal networks, improve fraud investigations, detect insider fraud, and expose money laundering schemes. Similarly, government agencies use link analysis to investigate fraud, enhance screening processes, uncover terrorist networks and investigate criminal activities.

At Crime Tech Solutions, we liken the question of how to detect and deter fraud to ‘How do you eat an elephant?’ The answer, of course, is one bite at a time. If big data is the elephant, comprehensive link analysis software is part of the one ‘bite’ at a time. Or should we say ‘byte’.

(NOTE: Crime Tech Solutions is an Austin, TX based provider of investigation software and analytics for commercial and law enforcement groups. We proudly support the Association of Certified Fraud Examiners (ACFE), International Association of Chiefs of Police (IACP), Association of Law Enforcement Intelligence Units (LEIU) and International Association of Crime Analysts (IACA). Our offerings include sophisticated link analysis software, an industry-leading investigation case management solution, and criminal intelligence database management systems.)

Tag Archives: financial crimes

Uncovering Fraud means Uncovering Non-Obvious Relationships

Posted by Tyler Wood, Operations Manager at Crime Tech Solutions

Although no fraud prevention measures are ever 100% foolproof, significant progress can be achieved by looking beyond the individual data points to the relationships between them. This is the science of link analysis.

Looking at data relationships isn’t straightforward and doesn’t necessarily mean gathering new or more data. The key to battling financial crimes it is to look at the existing data in a new way – namely, in a way that makes underlying connections and patterns using powerful but proven tools such as the Sentinel Visualizer software offered by Crime Tech Solutions.

Unlike most other ways of looking at data, link analysis charts are designed to exploit relationships in data. That means they can uncover patterns difficult to detect using traditional representations such as tables.

Now, we all know that there are various types of fraud – first-party, insurance, and e-commerce fraud, for instance. What they all have in common is the layers of dishonesty to hide the crime. In each of these types of fraud, link analysis from Crime Tech Solutions offers a significant opportunity to augment existing methods of fraud detection, making evasion substantially more difficult.

Let’s take a look at first-party fraud. This type of fraud involves criminals who apply for loans or credit cards but who have no intention of ever paying the money back. It’s a serious problem for banks, who lose tens of billions of dollars every year to this form of fraud. It’s hard to detect and the fraudsters are good at impersonating good customers until the moment they do their ‘Bust-Out,’ i.e. cleaning out all their accounts and disappearing.

Another factor is the nature of the relationships between the participants in the fraud ring. While these characteristics make these schemes very damaging, it also renders them especially vulnerable to link analysis methods of fraud detection.

That’s because a first-party fraud ring involves a group of people sharing a subset of legitimate contact information and bogus information, and then combining them to create a number of synthetic identities. With these fake identities, fraudsters open new accounts for new forms of loans.

The fraudsters’ accounts are used in a normal manner with regular purchases and timely payments so that the banks gain confidence and slowly increase credit over time. Then, one day… Poof! The credit cards are maxed out and everyone has disappeared. The fraudsters are long gone and ready to hit the next bank down the road.

Gartner Group believes in a layered model for fraud prevention that starts with simple discrete methods but progresses to more elaborate types of analysis. The final layer, Layer 5, is called “Entity Link Analysis” and is designed to leverage connections in data in order to detect organized fraud.

In other words, Gartner believes that running appropriate entity link analysis queries can help organizations identify probable fraud rings during or even before the fraud occurs.

More and more banks turning to biometrics for security

Perhaps a nice change at NICE Actimize?

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Though not publicly released, news out of NICE Actimize is that long-time CEO Amir Orad is leaving the company effective May 1. Indicative of the ‘what a small world this is’ nature of the financial crimes technology marketplace, former Pegasystems co-founder and head of Americas for BAE Systems Detica, Joe Friscia, will be taking over the helm at that time.

Mr. Orad led NICE Actimize’s product and strategy functions prior to his five year tenure as CEO. During his tenure, he scaled the business size over six-fold. He is also a founding board member at BillGuard the venture backed personal finance analytics and security mobile app company.

Prior to Actimize, Orad was co-founder and CMO of Cyota a cyber security and payment fraud cloud company protecting over 100 million online users, acquired by RSA Security for $145M. Following the acquisition, he was VP Marketing at RSA.

I’ve known both Amir and Joe for several years, and have a tremendous amount of respect for both gentlemen. While it’s sad to see Amir leave the organization, I know that his rather large shoes will be more than adequately filled by Mr. Friscia.

Joe’s background is well-suited to this new position, and all of us here at FightFinancialCrimes wish him well. Joe joined Detica when BAE Systems acquired Norkom Technologies in early 2011, where he served as General Manager and Executive Vice President of the Americas. Joe led the rapid growth of Norkom in the Americas, with direct responsibility for sales, revenue and profit as well as managing multi-discipline teams based in North America. Prior to Norkom, Joe helped start Pegasystems Inc in 1984, a successful Business Process Management software company that went public in 1996.

Best of luck to Amir in his new ventures, and to Joe as he guides Actimize into it’s next phase.

Part Two: Major Investigation Analytics – Big Data and Smart Data

Posted by Douglas Wood, Editor.

As regular readers of this blog know, I spend a great deal of time writing about the use of technology in the fight against crime – financial and otherwise. In Part One of this series, I overviewed the concept of Major Investigation Analytics and Investigative Case Management.

I also overviewed the major providers of this software technology – Palantir Technologies, Case Closed Software, and Visallo. The latter two recently became strategic partners, in fact.

The major case for major case management (pun intended) was driven home at a recent crime and investigation conference in New York. Full Disclosure: I attended the conference for educational purposes as part of my role at Crime Tech Weekly. Throughout the three day conference, speaker after speaker talked about making sense of data. I think if I’d have heard the term ‘big data’ one more time I’d have gone insane. Nevertheless, that was the topic du jour as you can imagine, and the 3 V’s of big data – volume, variety, and velocity – remain a front and center topic for the vendor community serving the investigation market.

According to one report, 96% of everything we do in life – personal or at work – generates data. That statement probably best sums up how big ‘big data’ is. Unfortunately, there was very little discussion about how big data can help investigate major crimes. There was a lot of talk about analytics, for sure, but there was a noticeable lack of ‘meat on the bone’ when it came to major investigation analytics.

Nobody has ever yelled out “Help, I’ve been attacked. Someone call the big data!”. That’s because big data doesn’t, in and by itself, do anything. Once you can move ‘big data’ into ‘smart data’, however, you have an opportunity to investigate and adjudicate crime. To me, smart data (in the context of investigations) is a subset of an investigator’s ability to:

- Quickly triage a threat (or case) using only those bits of data that are most immediately relevant

- Understand the larger scope of the crime through experience and crime analytics, and

- Manage that case through intelligence-led analytics and investigative case management, data sharing, link exploration, text analytics, and so on.

Connecting the dots, as they say. From an investigation perspective, however, connecting dots can be daunting. In the children’s game, there is a defined starting point and a set of rules. We simply need to follow the instructions and the puzzle is solved. Not so in the world of the investigator. The ‘dots’ are not as easy to find. It can be like looking for a needle in a haystack, but the needle is actually broken into pieces and spread across ten haystacks.

Big data brings those haystacks together, but only smart data finds the needles… and therein lies the true value of major investigation analytics.

Robbing the Casket, What Happens In Vegas, and Railroad Ripoffs: Selected Financial Crimes Snapshot 12/21/2013

To all of our readers… Have a great Christmas season and see you in 2014!

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Another case of worker’s compensation premium fraud. You may recall my previous post on this subject. It’s worth reading.

http://manasquan.patch.com/groups/police-and-fire/p/owner-of-wallbased-roofing-company-indicted-for-fraud-and-theft

You’ve heard of robbing the cradle. This is robbing the casket, I suppose…

http://www.13abc.com/story/24279926/funeral-home-owner-charged-with-theft-fraud

He’ll have 8 years to choo choo choose a new way to make a living…

http://newyork.cbslocal.com/2013/12/21/8-years-in-prison-for-former-lirr-conductor-in-fraud-scheme/

What happens in Vegas… Stays in a federal penitentiary.

http://www.lasvegassun.com/news/2013/dec/20/man-gets-11-years-15-million-mortgage-fraud-scheme/

Bananas, Politicians and Navy Blue: Selected Financial Crimes Snapshot 01/02/2013

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Be sure to check out “Investigating the Investigations” Part One and Two! In the meantime, here are this week’s weird headlines:

I can’t believe he tried to slip this one past investigators. Maybe he’ll win on a peel…

http://www.wjla.com/articles/2013/12/maurice-owens-to-appear-in-court-on-metro-banana-peel-fraud-charges-97541.html

A dishonest politician? Now I’ve heard everything!

http://www.wishtv.com/news/indiana/nw-indiana-politician-to-admit-6-wire-fraud-counts

He couldn’t just wait for Black Friday like everyone else?

http://www.hillsdale.net/article/20131202/NEWS/131209942

Navy blue about this one…

http://www.pbs.org/newshour/bb/military/july-dec13/navy_11-27.html

Drag Queens, Silk Road Shutdowns, and Video Killed the Real Estate Fraud – Selected Financial Crimes Snapshot 10/29/2013

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Perhaps there is no Spanish term for “lay low, fraudster”?

http://www.latimes.com/local/lanow/la-me-ln-youtube-video-leads-to-arrest-of-man-wanted-in-fraud-case-20131010,0,1636077.story#axzz2j9ClBao3

Feds take down “eBay for drugs” site. I wonder if “Buy it Now” was popular?

http://krebsonsecurity.com/2013/10/feds-take-down-online-fraud-bazaar-silk-road-arrest-alleged-mastermind/

Drag Queen Shakedowns… Only on Bourbon Street.

http://theadvocate.com/news/7402011-123/celebrity-scam-artist-arrested-in

Shockers, Lawyers, and Worst Boss Ever – Selected Financial Crimes Snapshot 10/11/2013

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Shipping a car to Nigeria? Seems like an awful lot of work for a fairly stupid scam…

http://finance.yahoo.com/news/fraud-conviction-man-reported-car-133000007.html

SHOCKER! Online advertising is often fraudulent!

http://www.sfgate.com/technology/businessinsider/article/4-Ad-Execs-Just-Admitted-That-Online-Adtech-Is-4888221.php

Why is it so darned hard to feel sorry for lawyers?

http://www.sun-sentinel.com/news/local/crime/fl-rothstein-attorney-arraign-20131011,0,4341539.story

“Here’s your paycheck. Gonna need half of it back, though.” Worst. Boss. Ever.

http://www.latimes.com/local/lanow/la-me-ln-contractor-indicted-fraud-wages-20131010,0,296609.story

Posted by Douglas G. Wood. Click on ABOUT for more information and follow Financial Crimes Weekly on Twitter @FightFinCrime

Gypsies, Tramps, and Thieves – Selected Financial Crimes Snapshot 10/4/2013

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

I’m sure the Gypsies just wanted to help… No?

http://www.greeleygazette.com/press/?p=23299

You just can’t make this stuff up. Thai prostitutes hired to kill rhinos in trophy hunting scam.

http://planetsave.com/2011/07/24/thai-prostitutes-hired-to-kill-rhinos-in-south-african-trophy-hunting-scam/

Ummm… she may have had a ‘brain injury’ when she thought this one up….

http://www.cnn.com/2013/09/30/justice/boston-one-fund/index.html

Good cop? No… bad cop

http://www.upi.com/Top_News/US/2013/10/04/Miami-police-officer-found-guilty-of-identity-theft-tax-fraud/UPI-26251380893747/

Posted by Douglas G. Wood. Click on ABOUT for more information and follow Financial Crimes Weekly on Twitter @FightFinCrime