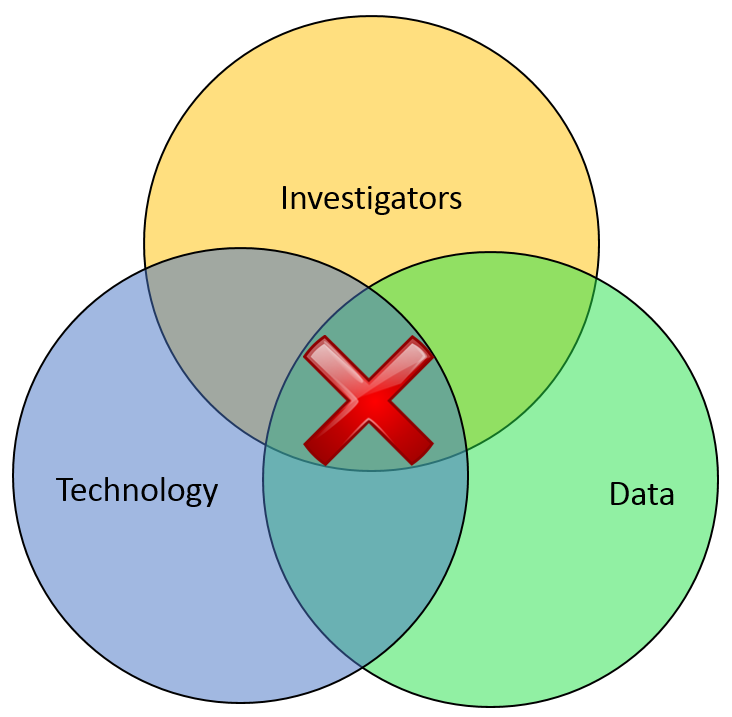

“The acquisition of BAIR Analytics builds on LexisNexis’ commitment to public safety, providing us the ability to combine BAIR Analytic’s analytical capabilities with our public records and linking technology to add context to crime patterns and enhance our ability to identify and locate persons of interest,” said Haywood Talcove, chief executive officer, LexisNexis Special Services, Inc. “The acquisition will be unique in the industry and help public safety officers make better decisions to close cases faster and improve community safety. In an era of constrained budgets, analytics are essential to optimize limited resources and increase overall efficiencies.”

BAIR Analytic’s analytical tools have been used by large and small public safety organizations worldwide for more than 20 years to help reduce and prevent criminal activity.

“Becoming part of LexisNexis will bring new opportunities to expand and build the best possible solutions to help our public safety customers,” said Sean Bair, President, BAIR Analytics. “BAIR Analytic’s ability to help agencies identify, analyze and resolve problems created by criminal offenders will be an exceptional complement to LexisNexis, its proven solutions and vast public records database to offer a more complete view of individuals to accelerate the investigation process.”

About LexisNexis Risk Solutions

LexisNexis Risk Solutions (http://www.lexisnexis.com/risk) is a leader in providing essential information that helps customers across all industries and government assess, predict and manage risk. Combining cutting-edge technology, unique data and advanced analytics, LexisNexis Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a world leading provider of professional information solutions.

BAIR Analytics

Established in 1997, BAIR Analytics (http://www.bairanalytics.com) is an analytical software and services company providing innovative tools and subject-matter expertise for public safety, private security, and national security and defense entities. Nearly half of the largest public-safety agencies in the United States use BAIR Analytic’s products & services to fight crime. BAIR Analytic’s current software tools are utilized by police departments, government agencies, and throughout the private sector worldwide to increase and promote smarter, community-oriented preventative policing.

# # #

Media Contact

Stephen Loudermilk

LexisNexis Risk Solutions

678.694.2353

stephen.loudermilk@lexisnexis.com