Posted by Douglas Wood, Editor.

Two weeks ago, I wrote in this space about some interesting experiences I’d had working through Workers Compensation Premium Fraud at a government run program. This week, I received a fraud alert about a retailer being banned from ever selling lottery tickets, and it reminded me of a great exercise I underwent with a government run Lottery corporation several years ago.

Lottery retailer fraud is simple and widespread. NBC Dateline ran a two hour episode several years ago, outlining the problem and going undercover to catch some bad guys in action.

In a nutshell, there are many unscrupulous retailers who outright lie to patrons when asked to check their numbers. Joe the customer hands the ticket over to the clerk and asks her to see if it’s a winner. She scans the barcode and says “Sorry, Joe… you didn’t win“. Then, as Joe heads out the door, she picks the ticket up from the trash bin knowing full well that it’s a big winner. Here’s a real life example.

How bad is the problem? According to Dateline NBC, a Philadelphia retailer cashed eighteen lottery tickets in three months for a total of $45,000. In New Jersey, a retailer cashed 105 lottery tickets for more than $236,000. In Illinois, it found one store where four employees and five of their relatives cashed a total of 556 winning tickets, for more than $1,600,000. In California, lottery investigators were seeing the same thing. In fact, in 2007, the five most frequent winners in California were retailers. One store owner in Los Angeles allegedly cashed 121 tickets for more than $160,000.

As a result of shrinking public trust and outrage, many lottery corporations have taken to more tightly scrutinize ‘winning’ ticket claims from lottery retailers. What, though, if the lottery clerk has her husband cash the ticket? Or her next door neighbor? How can you scrutinize large winning ticket claims without grinding the process to a halt?

That’s precisely where my customer was when they called me.

As with any fraud prevention program, the availability of data was of utmost importance as we scoped out the technology solution. The lottery corporation obviously knew who their retailers were (XYZ Groceries, ABC Petroleum, etc) but how did that help point to a specific Suzie Employee within that retailer? After all, companies weren’t cashing in winning tickets. People were.

Well, we helped them realize that they had employee names as a result of the mandatory training they offered retailers for handling sales of lottery tickets. Each employee of a retailer was required to take a brief online course for certification purposes, and entered some of their personal data (name, date of birth) in order to begin the training.

That got us through step one – the employees. In order to get to the next level of culprit (the family or neighbors of employees), we incorporated publicly available data into the mix.

Through a defined process of business discovery and problem resolution, we designed a process where individuals redeeming winning tickets above a certain value would be compared to the data of retail employees. If it was determined that a winner closely resembled a retail employee, an alert was automatically generated for investigators.

If a winner was determined to be closely acquainted to a retail employee via relationship-detection technology and public data, an alert was again generated. The specifics of how relationships were determined and analyzed won’t be disclosed for obvious reasons, but one example would be a shared address or telephone number.

This particularly lottery corporation was fortunate that they had a mechanism by which to collect employee data. In meeting with dozens of other Lotteries in the years since, I’ve learned that not enough of them have a similar process in place. Unfortunately, without that initial data set, it’s more difficult to detect this type of fraud.

In the case of my client, however, they began immediately seeing benefits in the new process and several fraudulent retailers were exposed. It was some very interesting work, and a cool exercise in problem solving for complex fraud.

Posted by Douglas G. Wood. Check out my site at www.crimetechsolutions.com

Category Archives: Financial Crimes

Premium Fraud – Piano Tuners and Window Washers?

Posted by Douglas Wood, Editor.

I came across a news article earlier this week regarding a business owner convicted of fraudulently avoiding worker’s compensation premiums. The link to that news article is below.

It brought to mind some fascinating work I was involved with a few years ago to help a state run Worker’s Compensation Bureau more effectively detect this kind of fraud. Their biggest concern was recovering monies owed by companies who illegally misrepresent themselves for the purpose of reducing or avoiding the payment of premiums. Here’s how these scams work…

Intentional Misclassification: A crooked business claims that employees work safer jobs than they really do. Perhaps a high-rise window washer is falsely classified as a piano tuner. Much lower premiums, obviously.

Employee Misrepresentation: A business says it has fewer employees or a lower payroll than it actually does.

Coverage Avoidance/Experience Modification: A business simply doesn’t buy the required insurance, hoping state officials won’t notice. If the state learns of the avoidance, the company will simply close, then re-emerge as a ‘new’ company’ in order to avoid the payments.

So the state bureau I worked with needed to understand when, for example, a ‘piano tuner’ was requesting a permit for high rise window washing. Red flag, right? Or when an five separate claims were filed by employees of a company who stated they had only 3 employees. Another red flag.

Oh, and what about a new company registrant whose owners, address, telephone number, and line of business are all suspiciously similar to those of a recently closed business who owed thousands of dollars in back premiums. BIG red flag.

The state itself had all of the data it needed to detect this fraud. The problem, as is often the case, is that the data sat in different jurisdictions. Working with our client, we helped those other jurisdictions – Business Registrations, Building Permits, Tax Departments, etc. – understand the value of sharing that data. That’s the key to this success story – data sharing. Without it, problems are much more difficult to solve.

Ultimately, we delivered a system that included business rules, anomaly detection, and social network analysis. It provided the bureau with the ability to flag those anomalies using their existing data infrastructure and fraud alert output from those other state agencies.

With the tools in place to trigger those red flags, the agency immediately began recovering lost premiums, prosecuting offenders, and ultimately adding much needed revenue to the state coffers.

Fraudsters who choose to commit financial crimes are always coming up with new scams. Those of us committed to delivering true technology innovations through data sharing are starting to put a real dent in their chosen profession, though.

Maybe they can tune pianos instead. Do they need a building permit for that?

http://www.workerscompensation.com/compnewsnetwork/mobile/news/17511-investigation-leads-to-conviction-of-ca-business-owner-for-insurance-fraud.htmlgus

Posted by Douglas G. Wood. Click on ABOUT for more information and follow Financial Crimes Weekly on Twitter @FightFinCrime

SEC taking stock of analytics (and a cool use case for stock exchanges)

Posted by Douglas Wood, Editor.

Posted by Douglas Wood, Editor.

I read with interest today an article about the SEC’s use of analytics in the ongoing fight against financial crimes. The link to that article is below. It reminded me of some work I once did with a major stock exchange around insider trading.

As a passionate anti-fraud technologist, I was thrilled with the challenge of helping the stock exchange better recognize cases of illegal insider trading. The results of the work we did was pretty cool.

The stock exchange – as do all exchanges – had a great deal of data at their disposal. They knew, for example, the names of each and every ‘insider’ within every company listed on their exchange. Insiders include senior executives, board members, legal counsel, auditors, and so on. Basically, everyone who knew – or ought to have known – about an upcoming event that would likely cause a significant change in stock price.

They also knew, of course, the identity of investors who traded profitably prior to the public release of that information. The problem was exposing the hidden relationships that might exist between Insiders and investors.

Here is an actual example… Joe Blow was an associate partner at the independent accounting firm responsible for auditing the quarterly financial results of publicly traded Company A. By definition, Joe is an insider. He knows Company A’s financials. Jane Doe dumped her entire position in Company A mere days ahead of what turned out to be very poor results. The stock plummeted, and Jane was saved from significant losses. She was seemingly a complete outsider. So, did she somehow know Joe Blow (or any other insider)? Or was she just one lucky gal.

Using link analysis, crime mapping, and behavioral analytics, we set about the challenge of finding out. Here’s what the analytics exposed:

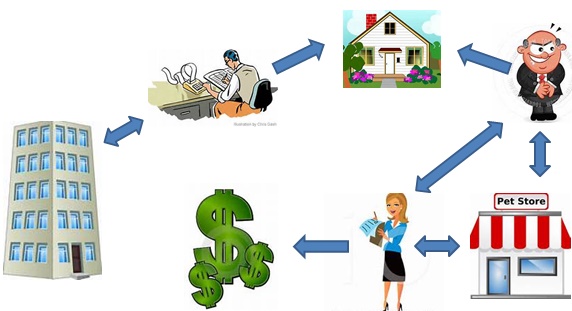

Joe Blow, the insider by way of being employed at Company A’s auditing firm, shared an address with… oh, let’s call him “Rich Quick”. Rich held no positions with Company A whatsoever. He did, however, own a pet food store with a lovely young lady. Can you guess her name? Yep.. Jane Doe. So, the analytics exposed that Company A had an insider relationship with Joe Blow. Joe lived with Rich Quick. Rich owned a business with Jane Doe. Coincidence? Not likely.

Without the ability to draw out hidden links between individuals and organizations, this case may never have been discovered. It’s like Six Degrees of Kevin Bacon, only with much higher stakes. All of the suspects were investigated and prosecuted.

(Note: All the names in this example are fictitious, but the case is not. If your name happens to be Jane Doe, Joe Blow, Rich Quick… or if you work for an organization called Company A, rest assured that I’m not talking about you.)

Here is the link to the SEC article. http://fcw.com/articles/2013/09/18/sec-taps-analytics-to-predict-risk.aspx?s=fcwdaily_190913 .