This week’s financial crimes headlines…

LexisNexis® Acquires BAIR Analytics, Leading Provider of Crime Analytics Solutions for Public Safety

“The acquisition of BAIR Analytics builds on LexisNexis’ commitment to public safety, providing us the ability to combine BAIR Analytic’s analytical capabilities with our public records and linking technology to add context to crime patterns and enhance our ability to identify and locate persons of interest,” said Haywood Talcove, chief executive officer, LexisNexis Special Services, Inc. “The acquisition will be unique in the industry and help public safety officers make better decisions to close cases faster and improve community safety. In an era of constrained budgets, analytics are essential to optimize limited resources and increase overall efficiencies.”

BAIR Analytic’s analytical tools have been used by large and small public safety organizations worldwide for more than 20 years to help reduce and prevent criminal activity.

“Becoming part of LexisNexis will bring new opportunities to expand and build the best possible solutions to help our public safety customers,” said Sean Bair, President, BAIR Analytics. “BAIR Analytic’s ability to help agencies identify, analyze and resolve problems created by criminal offenders will be an exceptional complement to LexisNexis, its proven solutions and vast public records database to offer a more complete view of individuals to accelerate the investigation process.”

About LexisNexis Risk Solutions

LexisNexis Risk Solutions (http://www.lexisnexis.com/risk) is a leader in providing essential information that helps customers across all industries and government assess, predict and manage risk. Combining cutting-edge technology, unique data and advanced analytics, LexisNexis Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a world leading provider of professional information solutions.

BAIR Analytics

Established in 1997, BAIR Analytics (http://www.bairanalytics.com) is an analytical software and services company providing innovative tools and subject-matter expertise for public safety, private security, and national security and defense entities. Nearly half of the largest public-safety agencies in the United States use BAIR Analytic’s products & services to fight crime. BAIR Analytic’s current software tools are utilized by police departments, government agencies, and throughout the private sector worldwide to increase and promote smarter, community-oriented preventative policing.

# # #

Media Contact

Stephen Loudermilk

LexisNexis Risk Solutions

678.694.2353

stephen.loudermilk@lexisnexis.com

Using Link Analysis to untangle fraud webs

Posted by Douglas Wood, Editor.

NOTE: This article originally appeared HERE by Jane Antonio. I think it’s a great read…

Link analysis has become an important technique for discovering hidden relationships involved in healthcare fraud. An excellent online source, FierceHealthPayer:AntiFraud, recently spoke to Vincent Boyd Bryant about the value of this tool for payer special investigations units.

A former biometric scientist for the U.S. Department of Defense, Bryant has 30 years of experience in law enforcement and intelligence analysis. He’s an internationally-experienced investigations and forensics expert who’s worked for a leading health insurer on government business fraud and abuse cases.

How does interactive link analysis help insurers prevent healthcare fraud? Can you share an example of how the tool works?

One thing criminals do best is hide pots of money in different places. As a small criminal operation becomes successful, it will often expand its revenue streams through associated businesses. Link analysis is about trying to figure out where all those different baskets of revenue may be. Insurers are drowning in a sea of theft. Here’s where link analysis becomes beneficial. Once insurers discover a small basket of money lost to a criminal enterprise, then serious research needs to go into finding out who owns the company, who they’re associated with, what kinds of business they’re doing and if there are claims associated with it.

You may find a clinic, for example, connected to and working near a pharmacy, a medical equipment supplier, a home healthcare services provider and a construction company. Diving into those companies and what they do, you find that they’re serving older patients for whom multiple claims from many providers exist. The construction company may be building wheelchair ramps on homes. And you may find that the providers are claiming payment for dead people. Overall, using this tool requires significant curiosity and a willingness to look beyond the obvious.

Any investigation consists of aggregating facts, generating impressions and creating a theory about what happened. Then you work to confirm or disconfirm your theory. It’s important to have tools that let you take large masses of facts and visualize them in ways that cue you to look closer.

Let’s say you investigate a large medical practice and interview “Doctor Jones.” The day after the interview, you learn through link analysis that he transferred $11 million from his primary bank account to the Cayman Islands. And in looking at Dr. Jones’ phone records, you see he called six people, each of whom was the head of another individual practice on whose board Dr. Jones sits. Now the investigation expands, since the timing of those phone calls was contemporaneous to the money taking flight.

Why are tight clusters of similar entities possible indicators of fraud, waste or abuse?

Bryant: When you find a business engaged in dishonest practices and see its different relationships with providers working out of the same building, this gives rise to reasonable suspicion. The case merits a closer look. Examining claims and talking to members served by those companies will give you an indication of how legitimate the operation is.

What are the advantages of link analysis to payer special investigation units, and how are SIUs using its results?

Bryant: Link analysis can define relationships through data insurers haven’t always had, data that traditionally belonged to law enforcement.

Link analysis results in a visual reference that can take many forms: It can look like a family tree, an organizational chart or a time line. This reference helps investigators assess large masses of data for clustering and helps them arrive at a conclusion more rapidly.

Using link analysis, an investigator can dump in large amounts of data–such as patient lists from multiple practices–and see who’s serving the same patient. This can identify those who doctor shop for pain medication, for example. Link analysis can chart where this person was and when, showing the total amount of medication prescribed and giving you an idea of how the person is operating.

What types of data does link analysis integrate?

Bryant: Any type of data that can be sorted and tied together can be loaded into the tool. Examples include telephone records, addresses, vehicle information, corporate records that list individuals serving on boards and banking and financial information. Larger supporting documents can be loaded and linked to the charts, making cases easier to present to a jury.

Linked analysis can pull in data from state government agencies, county tax records or police records from state departments of correction and make those available in one bucket. In most cases, this is more efficient than the hours of labor needed to dig up these types of public records through site visits.

Is there anything else payers should know about link analysis that wasn’t covered in the above questions?

Bryant: The critical thing is remembering that you don’t know what you don’t know. If a provider or member is stealing from the plan in what looks like dribs and drabs, insurers may never discover the true extent of the losses. But if–as a part of any fraud allegation that arises–you look at what and who is associated with the subject of the complaint, what started as a $100,000 questionable claims allegation can expose millions of dollars in inappropriate billings spread across different entities.

Asking data questions

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood.

A brief read and good perspective from my friend Chris Westphal of Raytheon. The article is by Anna Forrester of ExecutiveGov.com.

Federal managers should invest in technology that would help them extract insights from data and base their investment decision on the specific problems and information they want to learn and solve, Federal Times reported Friday.

Rutrell Yasin writes that the above managers should follow three steps as they seek to compress the high volume of data their agencies encounter in daily tasks and to derive value from them.

According to Shawn Kingsberry, chief information officer for the Recovery Accountability and Transparency Board, federal managers should first determine the questions they need to ask of data then create a profile for the customer or target audience.

Next, they should locate the data and their sources then correspond with those sources to determine quality of data, the report said. “Managers need to know if the data is in a federal system of records that gives the agency terms of use or is it public data,” writes Yasin.

Finally, they should consider the potential impact of the data, the insights and resulting technology investments on the agency.

Yasin reports that the Recovery Accountability and Transparency Board uses data analytics tools from Microsoft, SAP and SAS and link analysis tools from Palantir Technologies.

According to Chris Westphal, director of analytics technology at Raytheon, organizations should invest in a platform that gathers data from separate sources into a single data repository with analytics tools.

Yasin adds that agencies should also appoint a chief data officer and data scientists or architects to assist the CIO and CISO on these areas.

Perhaps a nice change at NICE Actimize?

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Though not publicly released, news out of NICE Actimize is that long-time CEO Amir Orad is leaving the company effective May 1. Indicative of the ‘what a small world this is’ nature of the financial crimes technology marketplace, former Pegasystems co-founder and head of Americas for BAE Systems Detica, Joe Friscia, will be taking over the helm at that time.

Mr. Orad led NICE Actimize’s product and strategy functions prior to his five year tenure as CEO. During his tenure, he scaled the business size over six-fold. He is also a founding board member at BillGuard the venture backed personal finance analytics and security mobile app company.

Prior to Actimize, Orad was co-founder and CMO of Cyota a cyber security and payment fraud cloud company protecting over 100 million online users, acquired by RSA Security for $145M. Following the acquisition, he was VP Marketing at RSA.

I’ve known both Amir and Joe for several years, and have a tremendous amount of respect for both gentlemen. While it’s sad to see Amir leave the organization, I know that his rather large shoes will be more than adequately filled by Mr. Friscia.

Joe’s background is well-suited to this new position, and all of us here at FightFinancialCrimes wish him well. Joe joined Detica when BAE Systems acquired Norkom Technologies in early 2011, where he served as General Manager and Executive Vice President of the Americas. Joe led the rapid growth of Norkom in the Americas, with direct responsibility for sales, revenue and profit as well as managing multi-discipline teams based in North America. Prior to Norkom, Joe helped start Pegasystems Inc in 1984, a successful Business Process Management software company that went public in 1996.

Best of luck to Amir in his new ventures, and to Joe as he guides Actimize into it’s next phase.

Part Two: Major Investigation Analytics – Big Data and Smart Data

Posted by Douglas Wood, Editor.

As regular readers of this blog know, I spend a great deal of time writing about the use of technology in the fight against crime – financial and otherwise. In Part One of this series, I overviewed the concept of Major Investigation Analytics and Investigative Case Management.

I also overviewed the major providers of this software technology – Palantir Technologies, Case Closed Software, and Visallo. The latter two recently became strategic partners, in fact.

The major case for major case management (pun intended) was driven home at a recent crime and investigation conference in New York. Full Disclosure: I attended the conference for educational purposes as part of my role at Crime Tech Weekly. Throughout the three day conference, speaker after speaker talked about making sense of data. I think if I’d have heard the term ‘big data’ one more time I’d have gone insane. Nevertheless, that was the topic du jour as you can imagine, and the 3 V’s of big data – volume, variety, and velocity – remain a front and center topic for the vendor community serving the investigation market.

According to one report, 96% of everything we do in life – personal or at work – generates data. That statement probably best sums up how big ‘big data’ is. Unfortunately, there was very little discussion about how big data can help investigate major crimes. There was a lot of talk about analytics, for sure, but there was a noticeable lack of ‘meat on the bone’ when it came to major investigation analytics.

Nobody has ever yelled out “Help, I’ve been attacked. Someone call the big data!”. That’s because big data doesn’t, in and by itself, do anything. Once you can move ‘big data’ into ‘smart data’, however, you have an opportunity to investigate and adjudicate crime. To me, smart data (in the context of investigations) is a subset of an investigator’s ability to:

- Quickly triage a threat (or case) using only those bits of data that are most immediately relevant

- Understand the larger scope of the crime through experience and crime analytics, and

- Manage that case through intelligence-led analytics and investigative case management, data sharing, link exploration, text analytics, and so on.

Connecting the dots, as they say. From an investigation perspective, however, connecting dots can be daunting. In the children’s game, there is a defined starting point and a set of rules. We simply need to follow the instructions and the puzzle is solved. Not so in the world of the investigator. The ‘dots’ are not as easy to find. It can be like looking for a needle in a haystack, but the needle is actually broken into pieces and spread across ten haystacks.

Big data brings those haystacks together, but only smart data finds the needles… and therein lies the true value of major investigation analytics.

Major Investigation Analytics – No longer M.I.A. (Part One)

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Long before the terrorist strikes of 9/11 created a massive demand for risk and investigation technologies, there was the case of Paul Bernardo.

Paul Kenneth Bernardo was suspected of more than a dozen brutal sexual assaults in Scarborough, Canada, within the jurisdiction of the Ontario Provincial Police. As his attacks grew in frequency they also grew in brutality, to the point of several murders. Then just as police were closing in the attacks suddenly stopped. That is when the Ontario police knew they had a problem. Because their suspect was not in jail, they knew he had either died or fled to a location outside their jurisdiction to commit his crimes.

The events following Bernardo’s disappearance in Toronto and his eventual capture in St. Catharines, would ultimately lead to an intense 1995 investigation into police practices throughout the Province of Ontario, Canada. The investigation, headed by the late Justice Archie Campbell, showed glaring weaknesses in investigation management and information sharing between police districts.

Campbell studied the court and police documents for four months and then produced a scathing report that documented systemic jurisdictional turf wars among the police forces in Toronto and the surrounding regions investigating a string of nearly 20 brutal rapes in the Scarborough area of Toronto and the murders of two teenaged girls in the St. Catharines area. He concluded that the investigation “was a mess from beginning to end.”

Campbell went on to conclude that there was an “astounding and dangerous lack of co-operation between police forces” and a litany of errors, miscalculations and disputes. Among the Justice’s findings was a key recommendation that an investigative case management system was needed to:

- Record, organize, manage, analyze and follow up all investigative data

- Ensure all relevant information sources are applied to the investigation

- Recognize at an early stage any linked or associated incidents

- “Trigger” alerts to users of commonalities between incidents

- Embody an investigative methodology incorporating standardized procedures

Hundreds of vendors aligned to provide this newly mandated technology, and eventually a vendor was tasked with making it real with the Ontario Major Case Management (MCM) program. With that, a major leap in the evolution of investigation analytics had begun. Today, the market leaders include IBM i2, Case Closed Software, Palantir Technologies, and Visallo.

Recently, the Ottawa Citizen newspaper published an indepth article on the Ontario MCM system. I recommend reading it.

Investigation analytics and major case management

The components of major investigation analytics include: Threat Triage, Crime & Fraud Analytics, and Intelligence-Lead Investigative Case Management. Ontario’s MCM is an innovative approach to solving crimes and dealing with complex incidents using these components. All of Ontario’s police services use this major investigation analytics tool to investigate serious crimes – homicides, sexual assaults and abductions. It combines specialized police training and investigation techniques with specialized software systems. The software manages the vast amounts of information involved in investigations of serious crimes.

Major investigation analytics helps solve major cases by:

- Providing an efficient way to keep track of, sort and analyze huge amounts of information about a crime: notes, witness statements, door-to-door leads, names, locations, vehicles and phone numbers are examples of the types of information police collect

- Streamlining investigations

- Making it possible for police to see connections between cases so they can reduce the risk that serial offenders will avoid being caught

- Preventing crime and reducing the number of potential victims by catching offenders sooner.

See Part Two of this series here.

Robbing the Casket, What Happens In Vegas, and Railroad Ripoffs: Selected Financial Crimes Snapshot 12/21/2013

To all of our readers… Have a great Christmas season and see you in 2014!

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Another case of worker’s compensation premium fraud. You may recall my previous post on this subject. It’s worth reading.

http://manasquan.patch.com/groups/police-and-fire/p/owner-of-wallbased-roofing-company-indicted-for-fraud-and-theft

You’ve heard of robbing the cradle. This is robbing the casket, I suppose…

http://www.13abc.com/story/24279926/funeral-home-owner-charged-with-theft-fraud

He’ll have 8 years to choo choo choose a new way to make a living…

http://newyork.cbslocal.com/2013/12/21/8-years-in-prison-for-former-lirr-conductor-in-fraud-scheme/

What happens in Vegas… Stays in a federal penitentiary.

http://www.lasvegassun.com/news/2013/dec/20/man-gets-11-years-15-million-mortgage-fraud-scheme/

Part 2: Investigating the Investigations – X Marks the Spot

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Part One of this series is HERE.

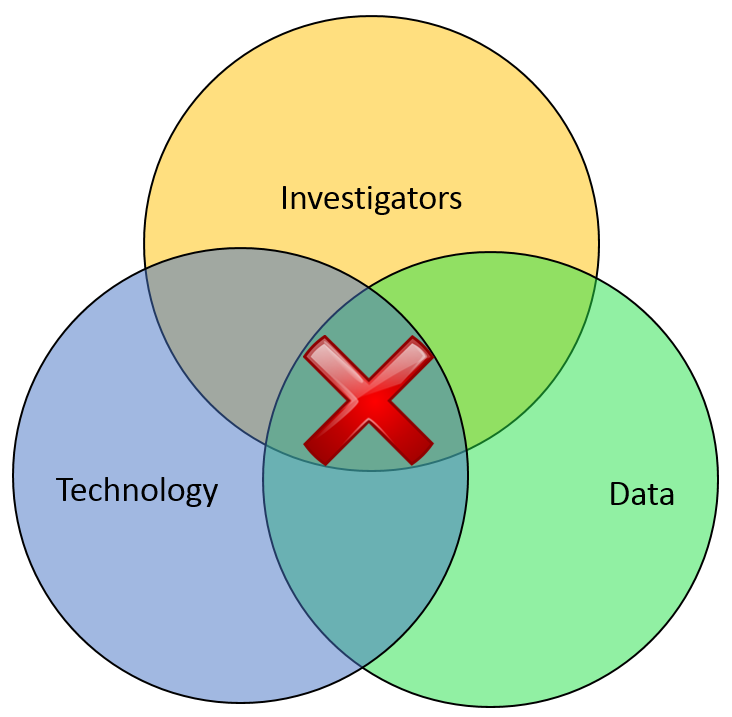

Most of the financial crimes investigators I know live in a world where they dream of moving things from their Inbox to their Outbox. Oh, like everyone else, they also dream about winning the lottery, flying without wings, and being naked in public. But in terms of the important roles they perform within both public and private sectors, there is simply Investigating (Inbox) and Adjudication (Outbox). Getting there requires a unique blend of their own capabilities, the availability of data, and the technology that allows them to operate. In the diagram below, ‘X‘ marks the spot where crimes are moved from the Inbox to the Outbox. Without any of those three components, an investigation becomes exponentially more difficult to conclude.

In part one of this article two weeks ago, I wrote about the Investigation Management & Adjudication (IMA) side of financial crimes investigations. I coined that term to call out what is arguably the most integral component of any enterprise fraud management (EFM) ecosystem. The original EFM overview is here.

“The job is almost unrecognizable to those who once used rotary phones in smoke filled offices…

Twenty years ago, IMA was based primarily upon human eyes. Yes, there were technology tools available such as Wordperfect charts and Lotus 1-2-3 spreadsheets, but ultimately it was the investigator who was tasked with finding interesting connections across an array of data elements including handwritten briefs, telephone bills, lists of suspect information, and discussions with other investigators. The job got done, though. Things moved from the Inbox to the Outbox, arrests were made and prosecutions were successful. Kudos, therefore, to all of the investigators who worked in this environment.

Fast forward to today, and the investigator’s world is dramatically different. The job is the same, of course, but the tools and mass availability of data has made the job almost unrecognizable to those who once used rotary phones in smoke filled offices. Organizations began building enterprise data warehouses designed to provide a single version of the truth. Identity Resolution technology was implemented to help investigators recognize similarities between entities in that data warehouse. And today, powerful new IMA tools are allowing easy ingestion of that data, improved methods for securely sharing across jurisdictions, automated link discovery, non-obvious relationship detection, and interactive visualization tools, and -importantly – packaged e-briefs which can be understood and used by law enforcement, prosecutors, or adjudication experts.

“Without any of these components, everything risks falling to the outhouse…

With all these new technologies, surely the job of the Investigator is becoming easier? Not so fast.

IMA tools – and other EFM tools – do nothing by themselves. The data – big data – does nothing by itself. It just sits there. The best investigators – without tools or data – are rendered impotent. Only the combination of skilled, trained investigators using the best IMA tools to analyze the most useful data available results in moving things from the Inbox to the Outbox. Without any of these components… everything eventually risks falling to the Outhouse.

Kudos again, Mr. and Mrs. Investigator. You’ll always be at the heart of every investigation. Here’s hoping you solve for X every day.

Bananas, Politicians and Navy Blue: Selected Financial Crimes Snapshot 01/02/2013

Posted by Douglas Wood, Editor. http://www.linkedin.com/in/dougwood

Be sure to check out “Investigating the Investigations” Part One and Two! In the meantime, here are this week’s weird headlines:

I can’t believe he tried to slip this one past investigators. Maybe he’ll win on a peel…

http://www.wjla.com/articles/2013/12/maurice-owens-to-appear-in-court-on-metro-banana-peel-fraud-charges-97541.html

A dishonest politician? Now I’ve heard everything!

http://www.wishtv.com/news/indiana/nw-indiana-politician-to-admit-6-wire-fraud-counts

He couldn’t just wait for Black Friday like everyone else?

http://www.hillsdale.net/article/20131202/NEWS/131209942

Navy blue about this one…

http://www.pbs.org/newshour/bb/military/july-dec13/navy_11-27.html